There are several situations when a TIN is required. Firstly, it may be a personal necessity when filling out documents if the TIN certificate is not at hand. Secondly, the reason may be the desire of the entrepreneur to check the IP of the counterparty for consistency and activity. Let's see how this is done.

Today, anyone can find out their tax number in just a few minutes. Various online services offer this opportunity:

- Portal "Gosuslugi".

Anyone can find out their tax number in just a few minutes.

And you can do it absolutely free. , but knowledge of passport data is required (full name, date and place of birth, series, number and date of issue of the certificate). What to do if there is no document, but you don’t remember the details or they don’t exist?

Is it possible to find out the TIN only by last name?

It is impossible and illegal to obtain information about an individual. But finding a TIN by the name of a person conducting commercial activities is easy. To search, you only need to know the full name and the region where the individual entrepreneur is registered.

How to determine the IP TIN online?

You can find out the TIN of an IP by last name directly on the tax website. Among the electronic services offered on the portal of the Federal Tax Service, you must select the heading "Business risks: check yourself and the counterparty" and enter the required data. Thus, you will receive not only the IP identification number, but also information about the date and place of registration, type of economic activity, and registration with the tax authority. The information is stored in a separate PDF document.

If you doubt the competence of the counterparty (and if you have no doubt, this is a typical procedure), do not be too lazy to check it. Finding out the TIN of an individual entrepreneur by his last name is a quick and easy procedure. But the information received will become an important criterion in determining the potential for further cooperation.

There was a need to request the TIN of a person? In this article, all methods and particular cases of checking the taxpayer identification code, all the necessary concepts and basic information related to this concept are considered as clearly and in detail as possible.

Taxpayer identification number: concept and features

Taxpayer Identification Number (TIN ) - a special code assigned to each citizen of the Russian Federation who pays taxes to the state budget. This code is assigned by the tax authority to individuals and enterprises at the time of registration. TIN helps the Federal Tax Service to monitor the timely payment of taxes. When fixing the number, the citizen is issued a document containing all the necessary information about the person and this identification code. The document is called "Certificate of Registration individual at the tax authority.

The registration procedure requires the submission of the following list of documents:

- Application for registration with the tax authority (form 2-2 "Accounting"), a form filled out manually or pre-filled in in electronic format and printed.

- A copy of the Russian Federation passport or other certifying document containing information about the person's registration address.

- If there is no information about the registration address, it is also necessary to attach a notarized copy of the document containing information about the registration address.

- If the person receiving the certificate of assignment of the taxpayer code does not live at the registration address, the tax inspector may also require information about the residence address and telephone number for contact.

Copies of documents must be notarized.

Each citizen is once assigned a unique combination of numbers that cannot be found in another citizen. The code is assigned once, and it is impossible to receive several versions of the code for one person.

Upon the initial receipt of a certificate, the state does not charge any payments from citizens, however, if the certificate is lost or the need to obtain a copy, the citizen is obliged to pay state duty, and attach a copy of the receipt of its payment to the above documents. Persons engaged in entrepreneurial activities and civil servants are strictly required to obtain an identification number.

Code decryption

The assignment of a unique code to each taxpayer is due to the exact identification of the person and the elimination of the possibility of repetition or double counting. The code consists of twelve digits, each of which carries certain information. According to the type of information encoding, the TIN number can be designated as

111122222233, where:

- 1111 - carry information about the subject of the Russian Federation, the tax office of which assigns a code to a person.

- 222222 - serial number of the entry in the register, under which there is an entry about this individual.

- 33 - a control number specially calculated by the tax authority.

The difference between the TIN of an individual and the TIN of a legal entity

- The taxpayer code of an ordinary citizen consists of 12 digits. For a legal entity, the code is made up of 10 digits.

- The unique combination is based on the information about the address of residence, appearing in the citizen's passport. The organization receives a code in accordance with its legal address, which reflects the location of the organization.

- The TIN assigned to the company cannot ever be registered for another organization. In case of liquidation of the company and its deregistration, this code is invalidated.

- The identification code of an individual entrepreneur who has made a decision to terminate activities is not invalidated and is not lost, remaining unchanged and assigned to him as an individual until death.

Why is a TIN required for an individual

- Carrying out business activities. A citizen is obliged to obtain a Certificate of registration in the event that he decided to carry out entrepreneurial activities. In the future, information about him can be requested in the Unified State Register of IP precisely by the identification number, which does not change if the person has ceased entrepreneurial activity.

- Citizen's request for tax deductions.

- Submission of a tax return.

- Participation in government auctions.

A document on the assignment of a taxpayer code may be required when a citizen submits an application for participation in state auctions, as well as when issuing a qualified digital signature proving a person's identity on state portals.

The applicant may be asked to provide a copy of the TIN certificate, even if the job is not related to the public service. This is required for ease of calculating personal income tax.

The citizen has never received a taxpayer identification code and does not have an appropriate document. Does it have an identification number?

No, as the tax authority will automatically assign the appropriate code to him when paying taxes, for example, on transport, or when receiving benefits.

Can the TIN change?

An identification number is assigned to a citizen once, and is valid throughout his life. Upon death of an individual given number is declared invalid. However, the question arises whether it is necessary to replace the TIN or tax registration certificate if:

The person moved to a new place of residence and changed the address of registration

In the event of a change of residence, the identification code does not change. A citizen can receive a new certificate containing information about the previous number. The tax authority, having received information about registration at a new address, will notify the tax office, in which the citizen was previously registered, of the change of residence.

To obtain a new certificate, you must have:

- Completed by hand or electronic form and a printed certificate application.

- A document containing a mark on the place of residence of a citizen.

- For individual entrepreneurs: a copy of the certificate of assignment of TIN with a mark of the tax office at the previous place of residence on deregistration.

There was a change of full name, date of birth, place of birth, gender

IN this case a person can get new document on assignment of a TIN with a new taxpayer code. It will contain the former identification number of the citizen.

To replace the Certificate, you need to prepare:

- A manually completed or electronically completed and printed Application for the issuance of a certificate.

- Previously received certificate of tax registration.

- Passport or other identification document.

- A document containing a note on the place of residence of an individual.

How to find out your TIN

If you have a certificate of assignment of a TIN

The desired combination is twelve digits, reflected in the Registration Certificate under the information about the full name of the document owner, his birthday, place of birth, gender and date of registration with the tax office.

Below is the territorial code of the tax authority, consisting of 4 digits.

Online

The request for a unique taxpayer code does not contradict the legislation of the Russian Federation, since personal number taxpayer does not apply to confidential information!

To obtain information about the assigned number, you need:

- Enter the full name reflected in the documents;

- Indicate the type of identity document (for citizens of the Russian Federation - a passport);

- Enter the series, passport number;

- Enter date of birth

The search will not be carried out in the absence of the above information.

Produced with the help of government sites:

- State portal "Gosuslugi" http://www.gosuslugi.ru/pgu/fns/findInn

- Website of the Federal Tax Service: https://service.nalog.ru/inn-my.do

After entering the security code, the portal will display information about the TIN assigned to the individual, if any.

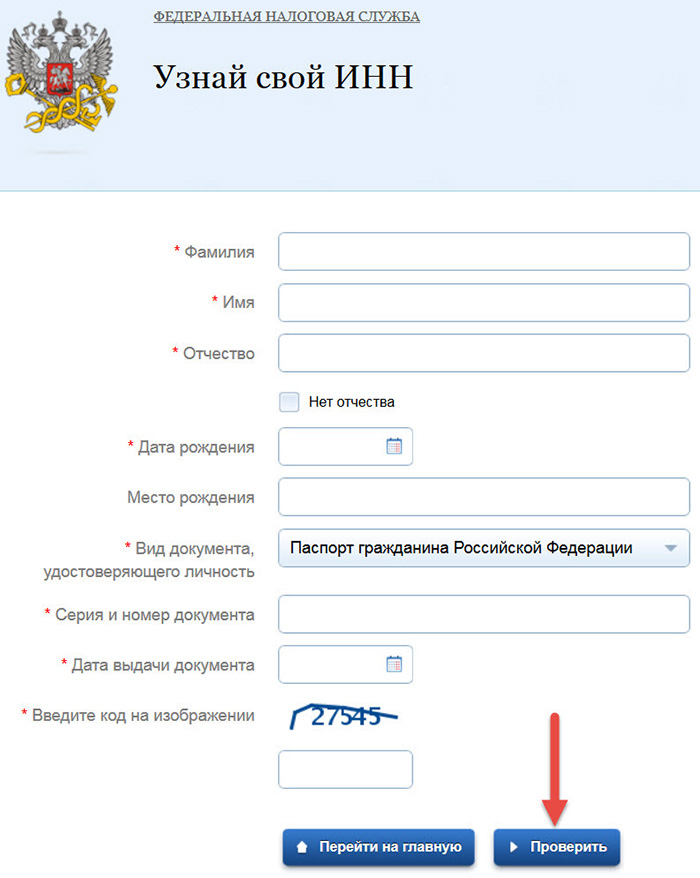

Procedure for finding out your TIN online

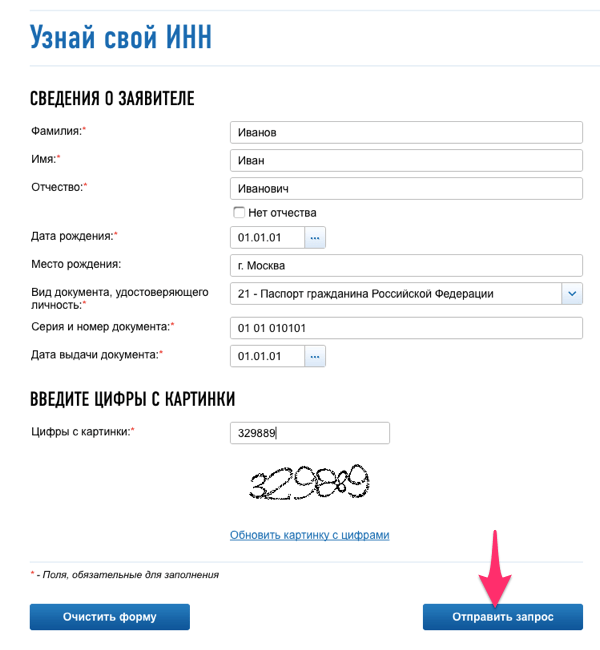

An example of requesting an identification code on the FTS portal:

- Go to the site: https://service.nalog.ru/inn.do

- Select the appropriate button: find out your TIN / someone else's TIN.

- If you need to find out your TIN, the form is found:

- Surname (required information).

- Name (required information).

- Patronymic (in the absence of a mark in the next column, refers to the mandatory information provided).

- Date of birth (required information).

- Place of birth (if available).

- Type of identification document - select from the list.

- Series, document number (information is required).

- Date of issue of the document - information is required).

- Enter the security code - numbers or letters from the picture.

- Press the "Get" button.

- Information about the citizen will be displayed on the computer screen.

Similar steps can be done on the public services portal.

How to check someone else's TIN of an individual

To request a taxpayer number, the tax service website sets the following requirements:

- Select the type of applicant.

- Provide information about the applicant. Mandatory: TIN, full name (in the absence of a middle name, a mark is put), date of birth, identity document, its series and number, date of issue; Place of birth is not required.

- Write in the columns information about the requested person.

- Enter the security code: numbers or letters from the picture.

- Press the "Submit" button.

- The information of interest will be displayed on the computer screen.

I need an identification number, but there is no passport data at hand! What to do?

The fact is that the passport data of the requested citizen must be indicated. If a person is engaged in entrepreneurial activities, it is possible to request his TIN number. What should be done:

- Go to the state portal "Nalog.ru" https://www.nalog.ru/

- Press the button "Business risks: check yourself and the counterparty" (located on the front page of the service)

- In the search criteria, indicate "Individual entrepreneur"

- Make active search for last name, first name, patronymic and region;

- Fill in the columns with data about the individual entrepreneur;

- Enter the control code from the picture;

- Press the "Find" button.

In the search results, you can see data on the citizen: full name, TIN, date of assignment of the OGRNIP, date of termination of activity (if any). If desired, by clicking on the full name of an individual entrepreneur, you can download the USRIP extract to your computer with full information about the entrepreneur and his activities.

In other cases, a request for a taxpayer code obliges the entry of passport data.

Based on the foregoing, the following conclusion can be drawn:

- A certificate of registration and assignment of a taxpayer identification code is issued by the Federal Tax Service within no more than five days from the submission of the required documentation.

- Identification does not change when a person's address changes.

- The change of the fixed code (with a record of the previous encoding) occurs if at least one type of data specified in the certificate is changed, except for the place of birth.

- To request a taxpayer code using the Internet, the passport details of the requested person are required. This can be done using the portal "Gosuslugi" or on the portal of the Federal Tax Service.

TIN or taxpayer identification number is a unique digital code assigned to citizens and organizations at the time of registration with the tax authority.

In order to obtain a paper on the assignment of a TIN, you need to contact the tax office at the place of residence. And if you just need to find out your identification number, then all you need to do is enter your passport data on the tax website.

It is about how to find out the TIN online on the website of the tax office that we will tell in this short instruction.

Recently, the provision of electronic public services has become more and more high-quality and user-friendly, and now you can find out the TIN, including now in several ways and in just a few clicks on the site.

If you are registered on the Gosuslugi website, then the easiest way to find out your tax number is to log in to personal account and among the popular services to find the one you need.

If you are not a registered user of this portal, it's okay, the second method is not much more complicated and will only require you to enter some passport data to verify your identity.

How to find out the TIN online on the tax website

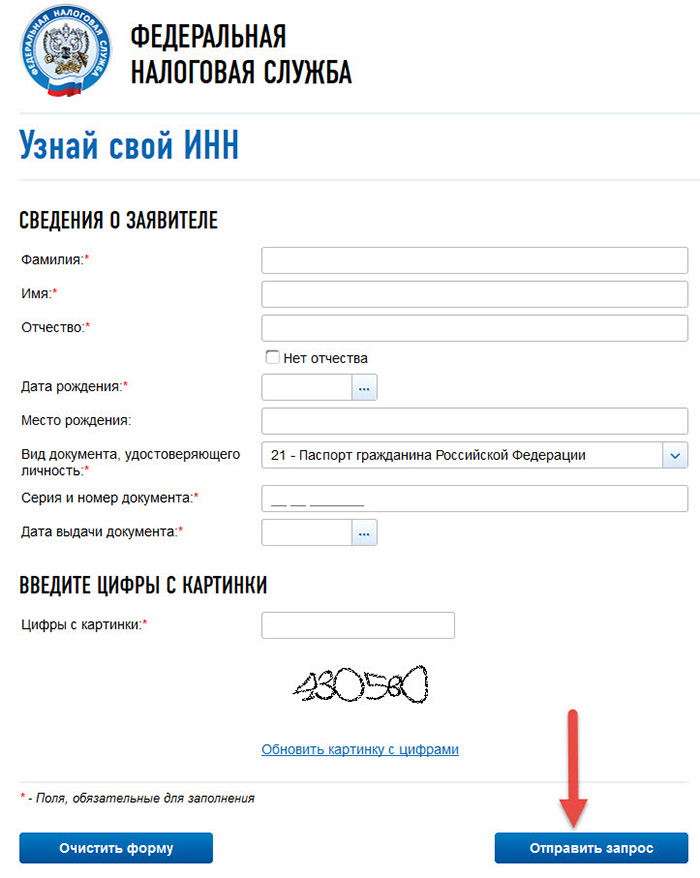

Any citizen registered with the tax authority can find out the TIN assigned to him on the website of the tax service nalog.ru without registration and without any waiting. Let's take a closer look at the case where we need find out TIN by passport data.

1. Open the website of the tax service

For citizens who are not registered on the public services portal, the opportunity find out your TIN by passport available on the website of the tax service at the link.

2. Fill in the details

On the page that opens, enter the passport details of the individual whose TIN you want to know. Fill in all the required fields, select the document whose data you are entering and enter the verification code from the image.

After all fields are filled in correctly, click the button "Submit Request".

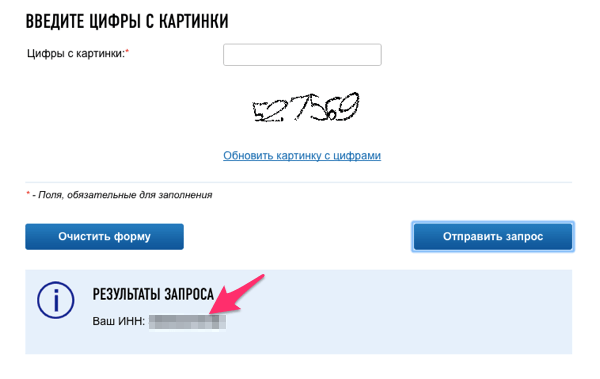

3. Find out your TIN

If you entered all the data correctly, as a result of pressing the button with a request, a line with the name will appear just below "QUERY RESULTS" where you will find your taxpayer identification number.

As you can see, it is very easy to find out your or someone else's TIN on the Internet and without registration, it is enough to know only some of the passport data of the individual whose identification number you need.

A taxpayer identification number (TIN) is a special code that is given to each taxpayer. It is indicated on the certificate of tax registration and may be required when applying for a job and making some financial transactions.

As practice shows, a person cannot always save this document, much less remember his TIN. Also, there are often cases when tax officials register a person without any notification, that is, without telling him his identification number.

Therefore, in this moment each individual has the opportunity to find out his TIN via the Internet.

How to find out the TIN number on the passport online

Having access to the Internet and a passport, each individual can obtain information about his TIN. To do this, it is enough to make a request to the tax service in a certain form, and then wait for a response containing the taxpayer identification number.

Where can it be done

TIN is not strictly confidential information, therefore it is quite legal to provide such data via the Internet. However, you can find out your identification number only on two official resources.

The first is the official website of the Federal Tax Service Russian Federation, the second is the portal of public services.

If some other site contains information that it can provide you with your TIN if you enter passport data, then you should not trust it. This site is most likely a scammer.

What is required for this

To find out information about your TIN via the Internet using the official website of the tax service or through the portal of public services, a citizen will have to enter his passport data in a form specially designated for this.

This form contains fields in which you must specify your first name, last name and patronymic, date of birth, place of birth, as well as the number, series and date of issue of an identity document.

It is not necessary to use only a passport. To fill out the form, you need to indicate the relevant information from the birth certificate, residence permit in the Russian Federation, temporary residence permit in the territory of the Russian Federation and some other documents.

Foreign nationals can also use their passport or birth certificate as proof of identity when filling out the form to obtain said data.

Instructions for filling out the form

In order to get data about your TIN online, an individual needs to go to one of the two proposed sites.

On the website of the tax service

An individual who decides to take the opportunity to find out his TIN on the website of the Federal Tax Service (nalog.ru) will need to do the following:

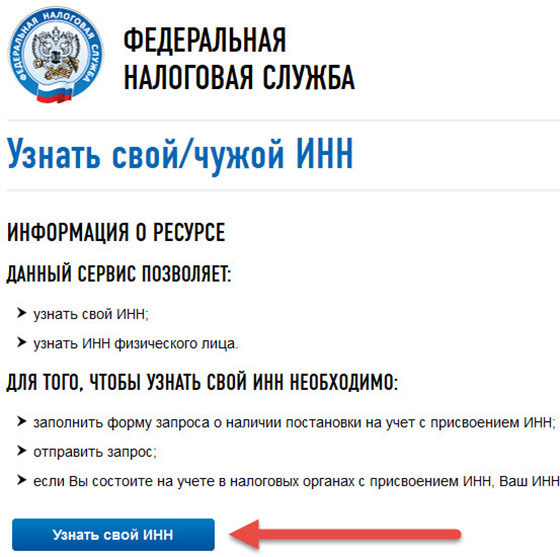

On the main page of the site in the "Electronic Services" section, click on the "Find out the TIN" button.

![]()

Acquainted with brief information about the conditions and process for providing information about the TIN, then click on the "Find out your TIN" button.

Fill out the form posted on the site.

- if a citizen does not have a middle name, he may not indicate it, but for this it is necessary to check the box "No middle name";

- the date of birth can be entered manually, or it can be noted on the proposed calendar;

- the "Place of birth" field is the only field on the entire form that is optional;

- in the field "Type of identity document" by default, "passport of a citizen of the Russian Federation" is set. If an individual is going to enter data about his other document, he needs to select his name in the proposed list;

- the date of receipt of the identity document, as well as the date of birth, can be entered manually or marked on the attached calendar;

- the field "Numbers from the picture" is necessary to confirm that the information is entered by a person, and not a robot. If the numbers in the picture are too illegible, they can be replaced by clicking on the "update picture with numbers" button.

If a citizen made any mistakes when filling out the form, he can click on the "Clear form" button and start filling it out again.

If everything is filled out correctly, then you need to click on the "Submit Request" button. After that, appears in the result field.

Video - how to find out your TIN on the site tax.ru:

On the portal of public services

Go to the "find out your TIN" section - LINK.

As well as on the website of the tax service, you must fill out the appropriate form and click the "check" button.

As a result of the search, the system will display: “The data was successfully received. Your TIN XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Video - how to find out your TIN on the public services portal:

For what reasons the identification number may not appear in the result field

Some individuals, when trying to find out their TIN, are faced with a problem that is expressed in an automatic message: “According to the information you specified, the TIN assigned when you registered with the tax authority was not found in the USRN FDB.”

The causes of this problem may be the following factors:

- Error filling out the form;

- Possession of a newer identity document;

- No TIN.

In the first two cases, the individual must re-fill out the form with the correct information.

In the absence of a TIN, a citizen should contact the tax office of his area of residence with an application for registration. You need to take a passport or other document with you to confirm your identity. The official website of the Federal Tax Service also provides citizens with the opportunity to file such.

Is it possible to know by last name

These services do not provide such an opportunity for individuals, so if a citizen wants to know his taxpayer identification number, he will need to enter his passport data in the form.

The procedure for obtaining information about the TIN is somewhat simplified only for individual entrepreneurs.

In order to find out your TIN, or one of your partners, it is enough to enter the last name, first name, patronymic of the taxpayer, as well as the region in which he lives.

In addition to the TIN, the tax service can also provide information about the type of economic activity that this taxpayer is engaged in and some other important, but not confidential information.

What data can be obtained about an individual by having his taxpayer identification number

No service provides such information about individuals. In this case, the exception is again made only by individual entrepreneurs. According to their TIN or OGRNIP (the main state registration number individual entrepreneur) you can find out not only the last name, first name and patronymic of the taxpayer, but also the address of his registration. This is also done, obtaining data in this way is completely legal.

Results

For whatever purposes the taxpayer needs to find out his identification number, he can do this without leaving home thanks to the electronic services of the Federal Tax Service and the public services portal. To do this, just fill out a fairly simple and short form, after which the tax service will provide the necessary information.

At the same time, individuals may not worry that someone will be able to find out their TIN and somehow use this information, because this data is not provided without indicating an identity document.