Sick leave, as well as other benefits, must be calculated based on the employee's income for the last two calendar years preceding the year of illness. And this refers to calendar years, that is, from January 1 to December 31 inclusive. But unlike the calculation of maternity and children's days, no days need to be excluded from the estimated time. That is, the billing period is always strictly 730 days. And it doesn’t matter if a leap year fell into the billing period, whether the employee worked both years completely and whether he worked in them at all, whether he was sick, etc.

How to calculate the maximum limit for maternity

Daily earnings when calculating maternity leave are calculated according to the following formula:

But that's not all. The result obtained must always be compared with the limit value. The fact is that, according to part 3.3 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ (hereinafter - Law No. 255-FZ), the average daily earnings for calculating maternity (as well as care benefits) in 2015 cannot exceed 1632.88 rubles. This figure is like this. We added the maximum values of the bases for insurance contributions to the FSS for each of the last two years (for 2013 and 2014 - these are 568,000 and 624,000 rubles). And then they divided it by 730. Note - it’s exactly 730, this figure is in this case expressly stated in the law.

If the estimated amount of daily earnings is less than 1632.88 rubles, then multiply it by 140. Otherwise, use 1632.88 rubles. That is, the total amount of maternity leave in 2015 cannot be more than 228,603.20 rubles. This is if the vacation is standard 140 days. With increased maternity leave, the maximum allowance will be 254,729.28 rubles. (for 156 days) or 316,778.72 rubles. (for 194 days).

Sick leave payment with continuation

There are times when the recovery process stretches for several months. For example, if an employee is involved in a serious accident. In this case, one insured event may be issued by several sick leave certificates. But this does not mean at all that the employee had two insured events. Mistakes in the allowance happen precisely because the first three days are paid at the expense of the company for each ballot.

The settlement period and, accordingly, the average daily earnings, it is enough to determine once, focusing on the opening date of the primary sheet. Therefore, the first three days at the expense of the employer, pay only for that sick leave, where the word “primary” is underlined.

If the employee presents two “primary” sick leaves to the accounting department, we are already talking about two insured events. This means that the employer must pay at his own expense the first three days for each of these two sheets.

In any case, you need to fill out all sick leave sheets. Moreover, many indicators will be identical. Only the dates on the line “Benefit due for the period” and the values of the lines “Benefit amount” and “TOTAL accrued” will differ. After all, you must calculate the allowance specifically for those days of illness that are indicated in the sick leave.

In addition, in all ballots, starting from the second, it is not necessary to fill in the line “From the employer's expense”. And the indicators for the lines “From the funds of the FSS of the Russian Federation” and “TOTAL accrued” will be equal.

And do not forget to attach your calculation of benefits to each sick leave (clause 67 of the Procedure approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n).

Errors in calculating sick leave for child care

The allowance is also due to employees for the time during which they care for their sick relatives. But the time during which an employee is entitled to receive benefits for the care of a child or other family member is generally limited. How much and for what period to calculate the allowance can be seen from the table (see below).

Terms of payment and amounts of benefits for caring for a sick family member

|

Benefit |

How many days can be paid at the expense of the FSS of Russia | Benefit amount |

| When caring for a child under the age of 7 | The entire period of outpatient treatment or joint stay with a child in a hospital, but not more than 60 calendar days a year for all cases of care for this child. In case of special illnesses of a child - no more than 90 calendar days a year for all cases of caring for this child. The list of such diseases was approved by order of the Ministry of Health and Social Development of Russia dated February 20, 2008 No. 84n | For outpatient treatment of a child - for the first 10 calendar days in the amount calculated in the usual manner. That is, taking into account the duration insurance experience. And for the following days - in the amount of 50 percent of the average earnings. In case of inpatient treatment of a child - in the usual amount, taking into account the duration of the insurance period |

| When caring for a child between the ages of 7 and 15 | A period of up to 15 calendar days for each case of outpatient treatment or joint stay with a child in a hospital. But at the same time, no more than 45 calendar days can be paid per year for all cases of caring for this child. | |

| When caring for a sick family member (except for children under 15 years of age). For example, for a sick parent | No more than 7 calendar days for each case of outpatient treatment. But at the same time, no more than 30 calendar days can be paid per year for all cases of caring for this family member | The allowance is paid in the amount determined depending on the duration of the insurance period. That is, sick leave is calculated in the usual manner |

Note that the doctor issues a certificate of incapacity for work to care for a sick family member without any restrictions on the total number of paid days in a calendar year. You must keep track of them. If the limit is reached, the time spent caring for a family member is simply not paid. But these days will nevertheless be considered a good reason for the absence of an employee at work.

The allowance for caring for sick family members is fully reimbursed by the FSS of Russia (part 3 of article 3 of Law No. 255FZ). That is, starting from the first day of illness, and not from the fourth, as in the case of diseases of the worker himself.

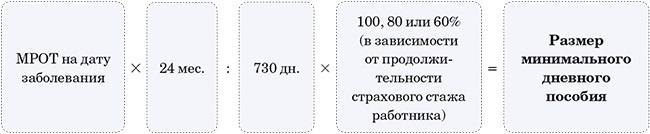

When calculating the allowance from the minimum wage, consider the length of service

If in the billing period the employee did not earn anything (or earned less than the minimum wage per month), sick leave should be calculated based on the minimum wage. The calculation in this case is normal, just instead of the employee's salary, you take the minimum wage (part 1.1 of article 14 of Law No. 255-FZ). Therefore, in this case, the insurance experience of the employee is important.

The formula for calculating the daily allowance in this situation is as follows:

Consider sick leave for a dismissed person with a limit of 60 percent

Sick leave is granted to those former employees whose illness or injury occurred within 30 calendar days from the date of dismissal. This is stated in Part 2 of Article 5 of Law No. 255-FZ. At the same time, the amount of sick leave for a former employee is 60 percent of his average earnings, regardless of length of service (part 2, article 7 of Law No. 255-FZ). There will be an error in the allowance if you calculate it in full

The duration of the illness does not matter - it does not matter whether the illness lasted four days or several months. An employee can claim payment for the entire period of illness. The main thing is that the sick leave must be opened within 30 calendar days from the date of dismissal. That is, even if the employee fell ill on the last day of this period, he is entitled to pay the entire sick leave. However, temporary disability benefits are prescribed only if the retired person himself fell ill or was injured, and not, for example, his children.

Pay the allowance to a part-time worker on the basis of a sick leave

Law No. 255-FZ identifies three situations related to part-time workers.

Situation one. The employee at the time of illness or maternity leave, as in the previous two calendar years, was employed by the same employers. Then the amount of the benefit is determined based on the average earnings accrued in each organization. References from other places of work do not need to be submitted.

Second situation. The employee is currently employed by several policyholders and was employed by other companies in the previous two calendar years. He can receive the allowance only in one of the places of the current work, of his choice. At the same time, the employee must submit a certificate from other organizations in which he works at the time of illness, stating that he was not assigned benefits there.

And the third situation. In the previous two calendar years, the employee was employed by both the current and other policyholders (another policyholder). Here, at the choice of the employee, the benefit is paid either by each of the organizations in which the employee works at the time of illness, or by one of the organizations in which the employee works at the time of illness. In the second case, again, a certificate will be required stating that the employee did not receive benefits at his other place of work.

In February 2014, an employee was on sick leave for 9 days.He brought a certificate from a previous job for 2013, in which he indicated earnings in the amount of 47,285 rubles.

There are no days excluded from the billing period.

Until 2013, this employee did not work anywhere.

The total insurance experience of the employee is 4 years.

Benefit calculation:

- We compare the average salary of an employee with the minimum wage (5,554 rubles).

RUB 47,285 : 24 months = 1,970 rubles. (1,970 rubles less than 5,554 rubles) - The average daily earnings (based on the minimum wage) will be equal to 182.60 rubles. (5,554 rubles x 24/730 days).

- The amount of temporary disability benefits will be 986.04 rubles.

(182.60 rubles x 9 days x 60%),

where 60% of the average earnings, since the experience is less than 5 years. - At the same time, 328.68 rubles are paid at the expense of the employer. (first 3 days)

at the expense of the FSS - 657.36 rubles. (for the rest of the period, starting from the 4th day).

Example 6

The employee was on sick leave for 5 days in February 2014.He submitted certificates from another organization where he worked as a part-time job, which indicated that his earnings

for 2012 amounted to 100,000 rubles,

for 2013 - 400,000 rubles.

In this organization, the employee's earnings for 2012 were equal to 400,000 rubles,

for 2013 - 512,000 rubles.

Insurance experience - 7 years.

Benefit calculation:

- The average salary of an employee for 2012 amounted to 500,000 rubles. (100,000 + 400,000)

- For 2013 - 912,000 rubles. (400,000 + 512,000),

however, we take into account 568,000 rubles. (See Maximum Benefit Amount) - Thus, the average daily earnings for calculating benefits is 1,463.01 rubles.

((500,000 rubles + 568,000 rubles) / 730 days). - Temporary disability benefit - 5,852.05 rubles.

(1,463.01 rubles x 5 days x 80%),

where 80% of the average earnings, since the insurance period of the employee is 7 years. - At the same time, 3,511.23 rubles are paid at the expense of the employer,

and at the expense of the FSS - 2,340.82 rubles.

Example 7

An employee of the organization presented two sick leaves at once.One - from 02/05/2014 to 02/11/2014,

the second - from 12.02.2014 to 06.03.2014 (continued).

His earnings

for 2012 - 524,000 rubles,

for 2013 - 684,000 rubles.

The employee's insurance experience is 9 years.

Benefit calculation:

- The average daily earnings for calculating temporary disability benefits will be equal to 1,479.45 rubles.

((512,000 rubles + 568,000 rubles) / 730 days), since

in 2012 - 524,000 rubles. > 512,000 rubles,

in 2013 - 684,000 rubles. > 568,000 rubles - Temporary disability allowance - 44,383.50 rubles.

(1,479.45 rubles x 30 days x 100%),

where 100% of average earnings, since the employee's insurance experience is 9 years. - At the same time, 4,438.35 rubles are paid at the expense of the employer,

at the expense of the FSS - 39,945.15 rubles. - Attention!

If the second certificate of incapacity for work was not a continuation of the first, it would be two different insured events.

This means that the employer for the first three days of temporary disability would have to pay this benefit for each sick leave.

Example 8

Since 11/01/2012, a student has been accepted to work part-time in the organization.Prior to that, he worked part-time for another employer (from 07/01/2012 to 10/31/2012),

where his earnings amounted to 32,000 rubles. (reference provided).

In this organization, his earnings

for 2012 was equal to 20,000 rubles,

for 2013 - 120,000 rubles.

From 03/13/2014 to 03/17/2014 (5 days) he was on sick leave.

Insurance experience - 3 years.

Is it possible to assign and pay temporary disability benefits to a part-time worker?

How to calculate the amount of such an allowance?

Benefit calculation:

- The average salary of an employee will be 172,000 rubles. (32,000 + 20,000 + 120,000)

- Average daily earnings - 235.62 rubles. (172,000 rubles / 730 days)

- The average daily wage, calculated on the basis of the minimum wage, is 182.60 rubles. (5,554 rubles x 24/730 days).

RUB 235.62 > RUB 182.60 - The temporary disability benefit will be equal to 706.85 rubles.

(235.62 rubles x 5 days x 60%). - At the same time, 424.11 rubles are paid at the expense of the employer,

at the expense of the FSS - 282.74 rubles.

Head of the department of legal support of insurance in case of temporary disability and in connection with maternity of the Legal Department of the FSS of the Russian Federation

Graduated from the Faculty of Law of Moscow State University. M.V. Lomonosov

More than 10 years working in the central office of the Social Insurance Fund of the Russian Federation

Interviewed by the correspondent of the Civil Code A.V. Khoroshavkina

Checking the sick leave, be vigilant!

Recently, inspectors from the FSS monitor the correctness of the calculation of sick leave benefits with particular predilection. And there are reasons for this: fake sick leave is becoming more and more. In order to change the situation, in the future the Fund plans to take sick leave from employees and pay benefits on them. In the meantime, accountants have to be vigilant.

What to look for when checking sick leave? How not to overdo it and not reject a completely correct sick leave? With such questions, we turned to the Social Insurance Fund.

Tatyana Mitrofanovna, what details of the disability certificate must the employer check?

T.M. Ilyukhin: The certificate of incapacity for work not only confirms the illness of a citizen, that is, the validity of the reasons for his absence from work. This is a financial document, the basis for the appointment and payment of benefits for temporary disability or for pregnancy and childbirth. Therefore, check the correctness of the sick leave a (hereinafter - the Order) you have to be very careful. Indeed, otherwise, if there are errors not noticed by the accountant in the sick leave, the FSS will not accept the cost of benefits I Part 4 Art. 4.7 of the Federal Law of December 29, 2006 No. 255-FZ "On compulsory social insurance in case of temporary disability and in connection with motherhood" (hereinafter - Law No. 255-FZ).

First of all, let me remind you that on the front side of the hospital, the doctor can make no more than two corrections. And each of these corrections is certified by the record "Corrected to believe", the signature of the attending physician and the seal of the medical organization. If there are more than two corrections, you need to contact the medical organization so that it issues a new one instead of this sick leave.

On the front side of the sick leave there should be a stamp of a medical institution or its name and address should be indicated. With p. 60 of the Procedure for issuing sick leave certificates by medical organizations, approved. Order of the Ministry of Health and Social Development of Russia dated August 01, 2007 No. 514 (hereinafter referred to as the Procedure).

The sick leave is certified by the signature of the attending physician and the seal of the medical organization. This seal is placed in the upper and lower right corners. X clause 75 of the Order. All seals and stamps must be legible.

Details must be checked literally everything, among them there are no unimportant ones. Let me remind them, because our reviewers constantly encounter errors:

In the line "Primary - continuation of sheet No. ..." the correct entry is underlined. And if this is a continuation, the number of the primary sick leave is indicated;

The line "Code of the medical organization" should contain its code according to OKPO;

In the line "Issued" - the day, month and year of issue, and the month must be indicated in words;

In the line "Surname, name, patronymic of the disabled" - the full name and patronymic, and not just the initials;

In the line "Age" - the number of full years;

In the column "Husband. Female.» the correct one must be emphasized;

In the line "Place of work" - the full or abbreviated name of your organization, such as in the constituent documents;

In the line "Main / part-time" - the correct one is underlined. And if this sick leave is submitted part-time, it must indicate the series and number of the disability certificate for the main job. Or, if a sick leave certificate for the main job was not issued, just write: “The sick leave certificate for the main job was not issued.” If a citizen works for one employer, the word "primary" is not underlined;

In the line “Indicate the reason for the disability”, the reason for the disability is underlined and this reason is written again. If the cause of the disability changes, the date of the change must be entered;

The line "Mode" indicates the type of prescribed regimen: inpatient, outpatient, sanatorium;

If there were violations of the regime, the type of violation should be indicated;

In the table "Exemption from work" in the columns "From what date" and "To what date inclusive" the day, month and year of the onset and end of the disease are indicated in Arabic numerals. Do not forget to also check the completion of the columns "Specialty and surname of the doctor" and "Doctor's signature".

Is it possible that if the doctor in the name of the employer organization wrote one of the letters in the middle of the word, which should be capitalized, small, it is no longer possible to accrue benefits for such a sick leave?

T.M. Ilyukhin: In order for such a sick leave to be able to accrue benefits, the doctor must make a correction to it - correct the small letter to capital Yu Art. 54 of the Civil Code of the Russian Federation; clause 60 of the Order.

How to fix a mistake on the back of a sick leave? How many corrections are allowed there?

T.M. Ilyukhin: Errors made when filling out the reverse side of the sick leave form are corrected in the same way as other primary accounting documents s paragraph 5 of Art. 9 of the Federal Law of November 21, 1996 No. 129-FZ "On Accounting". And the number of such corrections is not limited.

Corrections must be certified by the signature of the chief accountant. It is not necessary to certify corrections with the seal of the organization.

If you need to recalculate the benefit, then it is drawn up on a separate sheet indicating the series and number of the sick leave and the last name, first name and patronymic of the employee. The recalculation is certified by the signature of the chief accountant.

The employee was issued a certificate of incapacity for work for 20 days. He presented it to his employer on closing day. And the next day he did not go to work, because he opened a new sick leave in another clinic (possibly for the same disease).

Is it possible to receive sick leaves in a row for the same disease in different medical organizations? Does this require an additional opinion of the medical commission? Should an employer make a request to a medical organization to clarify diseases?

T.M. Ilyukhin: In general, in outpatient treatment of diseases, the doctor single-handedly issues a sick leave immediately for up to 10 calendar days, until the next examination. And then it can be extended each time for no more than 10 days, up to 30 calendar days in total th Clause 12 of the Order. If the patient has not recovered in 30 days, the sick leave is extended by the medical commission th Clause 14 of the Order.

But another polyclinic had the right to issue a new sick leave, even for the same disease, this is not prohibited. An additional conclusion of the medical commission is not necessary for this.

In such situations, we still advise you to check the validity of the issuance of sick leave. To do this, you can contact the territorial body of Roszdravnadzor with a request to check the validity of issuing a certificate of incapacity for work to this employee. This request is made primarily in the interests of the employer, as he is responsible for the targeted spending of social insurance funds. If later, during inspections, the FSS finds that this sheet was issued unreasonably and no benefits should have been paid on it, then these expenses will not be accepted for offset.

When applying for a job, the employee said that he had lost his work book. According to his statement, he was given a new one. This worker recently fell ill and received an allowance equal to 60% of average earnings, as he reportedly worked for about 2.5 years.

But soon the employee found an old work book and presented it to the accounting department, asking him to recalculate the allowance based on 100% of average earnings. Is it necessary to recalculate the allowance taking into account the data on the found work book?

T.M. Ilyukhin: Yes, after the employee submits the found old work book, he will need to recalculate the allowance. Recalculation must be done on a separate sheet.

The doctor filled out the front side of the temporary disability sheet in violation of the requirements of the Procedure, and because of this, the FSS refused to reimburse the benefit. Can an employer organization require a medical institution to reimburse the amount of benefits not accepted for offset?

T.M. Ilyukhin: Yes, the employer has the right to recover damages from the guilty person, that is, from the medical institution, in court e Art. 15 of the Civil Code of the Russian Federation.

But do not forget that if the violations in filling out the sick leave are remedied, the issue is resolved out of court. e Determination of the Supreme Arbitration Court of the Russian Federation of 03.05.2007 No. 4392/07. That is, if the FSS found violations during the audit, you can simply ask the medical institution to correct the sick leave or write out a new one. And then the FSS will take the cost of benefits.

The disability certificate was issued to the employee on May 5. On it is a mark about the establishment of the II group of disability - May 7th. The sick leave was closed on May 28. Will the FSS refuse to reimburse the amount of benefits? How to pay sick leave in such a situation?

T.M. Ilyukhin: If the employee is diagnosed with disability, the period of temporary disability ends on the date immediately preceding the day of registration of documents in the institution of medical and social expertise, that is, the day the disability was established. In this case it is 6 ma I clause 29 of the Order; Clause 12 of the Rules for Recognizing a Person as Disabled, approved. Decree of the Government of the Russian Federation of February 20, 2006 No. 95.

If the employee continues to get sick after the disability group has been established, he must be issued a new sick leave. In your situation, a new sick leave should have been issued from May 7th.

For persons with disabilities, there are restrictions on the payment of temporary disability benefits: no more than 4 months in a row or 5 months in a calendar year (except for cases of tuberculosis )Part 3 Art. 6 Law No. 255-FZ.

Due to what shortcomings in filling out a sick leave issued by a doctor to an external part-time worker, can the FSS refuse to reimburse benefits?

T.M. Ilyukhin: A certificate of incapacity for work issued at the place of work on an external part-time basis must be issued in exactly the same way as a certificate of incapacity for work for the main place of work. There is only one difference in filling out: you must indicate the name of the place of work, underline the words "part-time" and indicate the number of the disability certificate issued at the main place of work.

In practice, the grossest mistake is the submission at the place of part-time work of a copy of the disability certificate issued for the main place of work.

And if an employee - an external part-time job brought a sick leave, in which the doctor did not make a note “part-time” on the front side, can the organization itself make such a note? Or is it necessary to require the employee to ask the doctor to make such a note?

T.M. Ilyukhin: All corrections on the front side of the disability certificate must be done by a medical professional.

Since the front side of the disability certificate is filled out by an employee of a medical organization, the medical worker should also mark (underline) the words “main” or “part-time” on the front side. The employer is not entitled to make adjustments to the front side of the disability certificate.

And if this is the only place of work for an employee, and the doctor mistakenly underlined the word “main” - is this also a mistake and the expenses will not be accepted?

T.M. Ilyukhin: In that case, I believe the Foundation will accept the costs.

The employee is on parental leave until the child reaches the age of one and a half years at the main place of work. In another organization, she works as an external part-time worker. Is it possible to pay her temporary disability benefits?

T.M. Ilyukhin: If a woman works in an organization on a part-time basis, all labor guarantees apply to her. and Art. 93 of the Labor Code of the Russian Federation. And she has the right to receive temporary disability benefits if she herself or her child falls ill. to Part 2 Art. 13 of Law No. 255-FZ.

The employee in 2009 worked in another organization for employment contract. There is no record of this in the work book. But there is a salary certificate from this organization. In 2011, at a new place of work, he fell ill. Can this certificate be taken into account when calculating sick leave?

T.M. Ilyukhin: If there is no entry in the work book, the fact of the existence of an employment relationship is confirmed only by an employment contract. That is, one reference is not enough. When the employee submits an employment contract, the accountant will need to make a copy of it. Then, when calculating the allowance, the salary certificate will also be taken into account.

The employee asked to make a request to the FSS and the FIU for wages for the previous 2 years, because the previous job is in another area and he does not have the opportunity to go there. But there are still no answers. What advice would you give to an accountant?

T.M. Ilyukhin: In the territorial bodies of the FSS of the Russian Federation there is no information on the salary of insured persons. The request must be made to the territorial body of the Pension Fund a Part 7.2 Art. 13 of Law No. 255-FZ. Until you have received a response from the FIU, the sick leave benefit must be calculated based on the available data. And after receiving information from the FIU about the salary of an employee at his previous job, recalculate the allowance.

The employee was treated on an outpatient basis, then he was in the hospital, and after leaving the hospital, he continued to get sick, being again on an outpatient basis. How many disability certificates does he have to submit? How many sick days must an employer pay?

T.M. Ilyukhin: As a rule, a sick leave is issued and closed by one clinic or hospital. But if the patient is sent for treatment to another medical institution, then the original sick leave can be extended or closed by the doctor of this second medical institution. I Clause 6 of the Order. When a patient is sent for treatment to another medical institution, an entry on the extension of the sick leave is made on the same form, if there are free lines, and if there are no free lines, on a new one.

Usually, with a long-term illness, the patient is given two or more sick leaves. Simply due to the fact that there is not enough space on one form. But each subsequent sick leave is a continuation of the previous one.

Therefore, if the patient, after outpatient treatment, was sent for treatment to a hospital, then the original sick leave continues to be maintained by the hospital where he is being treated. Upon discharge, the attending physician of the hospital issues a sick leave certificate to the patient for the entire period of inpatient treatment. I clause 20 of the Order. If the patient is already healthy, he closes the sick leave, if he continues to get sick, he extends it, but not more than 10 days. At the end of this period, the patient must come to the clinic at the place of residence. Depending on his condition, the polyclinic doctor will close this sick leave or extend it again.

And the employer must pay benefits, regardless of the number of sick leave issued, for 3 days of illness and p. 1 h. 2 art. 3 Law No. 255-FZ. After all, there was only one accident.

Our publication has already addressed the issue of sick pay in cases where the first 3 days fall on periods for which benefits are not paid (for example, during unpaid leave or study leave). Then you confirmed to us that in these cases, the allowance for the remaining days is paid at the expense of the Social Insurance Fund. As far as we know, the FSS has clarified its position on this matter?

For the material devoted to this issue, see the heading "We asked - we answer": 2011, no. 9, p. 55T.M. Ilyukhin: I don't want to upset your readers, but it's true. The temporary disability benefit for the first 3 days of sickness, which are payable, is paid at the expense of the employer. That is, if an employee was ill from June 6 to 18, while from June 6 to 8 he was on vacation at his own expense or on study leave, he must be paid benefits from June 9. And for the first 3 days, from June 9 to June 11, the allowance is paid at the expense of the employer, and starting from June 12 - at the expense of the Social Insurance Fund. In this case, the date of the insured event will be the date when the employee was supposed to go to work.

The employee went to work during the period of illness, so he did not submit the initial sick leave.

How to pay for the continuation of sick leave without submitting an initial sick leave certificate? What settlement period for calculating temporary disability benefits should be taken if the onset of illness on the primary sick leave falls on December 2014, and the continuation of the sick leave - on January 2015?

April 7, 2015

After considering the issue, we came to the following conclusion:

The temporary disability benefit must be paid to the employee for the period of disability when he did not work and for which he lost his earnings. The calculation period for calculating temporary disability benefits is 2012 and 2013 (provided that, at the request of the employee, they were not replaced by the previous calendar years in order to calculate average earnings).

Rationale for the conclusion:

The conditions, amounts and procedure for providing benefits for temporary disability are determined by N 255-FZ of December 29, 2006 "On compulsory social insurance in case of temporary disability and in connection with motherhood" (hereinafter - Law N 255-FZ).

In accordance with Law N 255-FZ, the payment of temporary disability benefits is due to the occurrence of an insured event: in the case under consideration, temporary disability of the insured person due to illness or injury.

The basis for the appointment and payment of temporary disability benefits is a certificate of incapacity for work issued in the form approved by the Ministry of Health and Social Development of Russia dated April 26, 2011 N 347n (Federal Law N 255-FZ). The procedure for issuing sick leave certificates (hereinafter referred to as the Procedure) was approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n.

According to paragraph 6 of the Procedure in the event long-term treatment the medical organization issues a new certificate of incapacity for work (continued) and at the same time draws up a previous certificate of incapacity for work for the appointment and payment of temporary disability benefits. In this case, a case of temporary disability, completed by one completed period of disability, certified by a certificate of disability, taking into account all certificates of disability issued in continuation of the primary certificate of disability, should be considered one insured event of temporary disability (letter of the FSS of Russia dated 18.08.2004 N 02-18 / 11 -5676).

By virtue of Law N 255-FZ, temporary disability benefits in case of disability due to illness or injury, according to general rule, is paid to the insured person for the entire period of temporary incapacity for work until the day of restoration of working capacity (establishment of disability).

In the situation under consideration, the initial and subsequent sick leave issued in its continuation confirm one case of disability that began in December 2014. However, during the period of disability, confirmed by the first sheet, the employee continued to work.

In accordance with part four of the Labor Code of the Russian Federation, the employer is obliged to keep records of the time actually worked by each employee, and for the performance of labor duties under an employment contract, he is obliged to pay wages to the employee (, Labor Code of the Russian Federation).

The right to receive temporary disability benefits is a guarantee that protects working citizens from a possible change in material and (or) social status (, Federal Law of July 16, 1999 N 165-FZ "On the Basics of Compulsory Social Insurance"). The temporary disability benefit as a type of insurance coverage for compulsory social insurance is designed to compensate citizens for lost earnings due to the onset of temporary disability (, Law N 255-FZ). Therefore, its payment for the period during which the earnings were not lost is impossible and contrary to the law (see, for example, the Supreme Arbitration Court of the Russian Federation of March 24, 2010 N BAC-2812/10, the Arbitration Court of the Volgograd Region of April 19, 2010 N A12-3156 / 2010 , as well as the answer to the question "Is temporary disability benefits paid if the insured person continues to work during the period of disability?" posted on the website of the regional branch of the FSS of the Russian Federation for the Chukotka Autonomous Okrug - http://r87.fss.ru/answers/20497 /91495/index.shtml).

At the same time, it is obvious that if an employee went to work during the period of illness, this does not mean that he is able to work. The employee does not lose the right to be released from work during the period of incapacity for work and does not lose the right to receive benefits for the remaining days of incapacity for work when he did not work.

This conclusion is also confirmed by judicial practice (see, for example, the Civil Code of the Supreme Court of the Republic of Bashkortostan dated September 4, 2012 in case No. 33-8548/2012). Other specialists adhere to a similar position (see the answer of L.M. Novitskaya (FSS of Russia) to the question: “An employee was issued a sick leave due to pregnancy. However, she did not inform the administration of our company, but continued to work. the accounting department only on December 1, despite the fact that it was issued on October 1. How to pay for such a sick leave?" ("Salary", N 2, February 2008)).

Thus, for the period confirmed by the certificate of incapacity for work (including in cases when it was issued in continuation of the initial sheet), when the employee did not work and for which he lost his earnings, temporary disability benefits must be paid.

We note that going to work without an extract, in other words, the performance by an employee of labor duties during a period of temporary disability, is a violation of the hospital regime (clause 58 of the Procedure), which, in turn, by virtue of Law N 255-FZ, is the basis for reducing the amount temporary disability benefits. From the day such a violation was committed, temporary disability benefits are paid to the employee in an amount not exceeding the minimum wage established for a full calendar month. federal law, and in districts and localities in which district wage coefficients are applied in the prescribed manner - in an amount not exceeding the minimum wage, taking into account these coefficients.

However, in our opinion, without a mark on the disability certificate, the employee’s going to work during the period of illness cannot be considered a violation of the regimen, since the treatment regimen is established by the attending physician and only he (and not the employer) can determine whether the employee’s behavior goes beyond the prescriptions issued to him, or the regime cannot be considered violated. That is, formally, the employer has no reason to reduce the amount of temporary disability benefits * (1).

According to Law N 255-FZ, temporary disability benefits are calculated based on the average earnings of the insured person, calculated for two calendar years preceding the year of temporary disability. Accordingly, the date of the onset of temporary disability is important to determine the amount of the benefit. The date of temporary incapacity for work is the date indicated in the primary certificate of incapacity for work in the column "From what date" of the first line of the table "Release from work".

In the above situation, as we have already said, both sheets of disability confirm one case of temporary disability, completed by one completed period of disability. As follows from the question, the temporary disability of the employee occurred in 2014, therefore, for him, the billing period is 2012 and 2013 (provided that, at the request of the employee, they were not replaced by Law N 255-FZ in order to calculate the average earnings of the previous calendar years ).

At the same time, we believe that in the above situation, in order to pay for a certificate of incapacity for work issued in continuation of the primary one, the employee must also submit to the employer the primary certificate. Representatives of the FSS of the Russian Federation give similar explanations (see, for example, the answer to the question "The employee provided two sheets of disability for payment, and the second is a continuation of the first. But due to pale ink on the first sheet, the seal of the issuing clinic is not readable, as well as the last name, first name , patronymic and place of work of the employee. Is the accounting department entitled to pay only the second "sick leave", returning the first one for clarification?" ).

In conclusion, we note that the assigned allowance is paid for the first 3 paid days of temporary disability at the expense of the employer, and for the rest of the period - starting from the 4th day of temporary disability - at the expense of the budget of the FSS of Russia (Law N 255-FZ). Representatives of the FSS of Russia adhere to the same position (see, for example, the answer of the representative of the FSS of Russia Ilyukhina T.M. to the question: How is the temporary disability benefit paid if the disease occurs during administrative leave? // "Payment in a budgetary institution: accounting accounting and taxation", N 7, July 2011; as well as answers to similar questions posted on the official websites of the Yaroslavl regional branch of the FSS of Russia, the Moscow regional branch of the FSS of Russia at the links: http://fss.yaroslavl.ru/fl /vn/consultation01.php ,

http://r50.fss.ru/131058/131059/131064.shtml).

Prepared answer:

Legal Consulting Service Expert GARANT

Panova Natalia

Response quality control:

Reviewer of the Legal Consulting Service GARANT

Voronova Elena

March 18, 2015

The material was prepared on the basis of an individual written consultation provided as part of the Legal Consulting service.

*(1) Please note that this position is only our expert opinion and may not coincide with the position of the territorial body of the FSS. In this regard, on this issue, we recommend that you contact the FSS of the Russian Federation with a request for official clarifications by mail (107139, Moscow, Orlikov pereulok, 3a) or by leaving a request to